As nations navigate through the uncertainties of fluctuating U.S. interest rates and ongoing geopolitical tensions, gold continues to shine as an essential financial safeguard. Through the first part of 2025, gold not only affirmed its role as a critical asset but has also set a new record high, reinforcing its stature in the global financial landscape.

Central Bank Gold Accumulation: A Strategic Move

Around the world, the accumulation of gold by central banks is a testament to its enduring value across different market conditions. Countries hold onto gold for several pivotal reasons:

Stability and Reliability: Gold is universally recognized for its long-term value, particularly in times of economic turmoil. It bolsters confidence in a nation's financial health and serves as a dependable store of value.

Currency Stability: Although the gold standard's significance has diminished, gold reserves continue to play a vital role in ensuring currency stability for many countries. If a country holds a lot of gold in reserve, other nations tend to trust its currency more.

Diversification: Just like individual investors do, nation states incorporate tangible assets like gold into their reserves to diversify their asset portfolios, reducing overall risk.

Believe it or not, nearly 20% of all gold mined worldwide goes directly into the vaults of central banks, illustrating the metal's strategic importance.

Who's Stockpiling Gold?

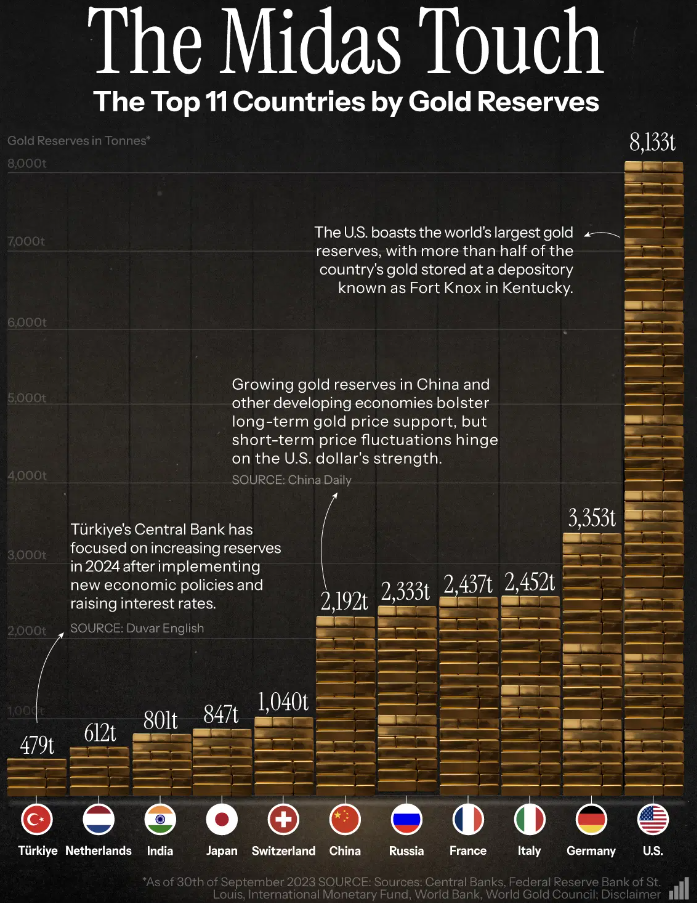

The United States leads the pack with the largest gold reserves in the world, securely stored across 12 Federal Reserve Banks and Fort Knox, totaling 8,133 tonnes. Following the U.S., Germany, Italy, France, Russia, and China are also major holders, highlighting the global consensus on gold's value as a financial buffer.

The U.S.: Home to the largest gold reserves globally, emphasizing its economic might and financial prudence.

Germany and European Counterparts: Significant reserves in Germany, Italy, and France underline gold's importance in European economic strategies.

Russia and China: These nations, key competitors on the geopolitical stage, have seen the largest increases in their gold reserves over the last 20 years, with China's People’s Bank purchasing 225 tonnes just last year.

The correlation between the countries with the most substantial gold reserves and the world's leading economies is not coincidental. It underscores the universal recognition of gold as a crucial asset in maintaining economic stability and confidence.

What This Means for Individual Investors

The strategic gold accumulation by central banks around the world sends a clear message about the metal's invaluable role in safeguarding financial security. For individual investors and customers of United Patriot Coin, this global trend should serve as a strong indicator of the wisdom in bolstering their own precious metals holdings.

Just as countries use gold to navigate through economic uncertainties and maintain financial stability, individual investors can also leverage gold to protect and diversify their portfolios. The continuous stockpiling of gold by the world’s central banks underscores the metal’s timeless value and its effectiveness as a hedge against economic challenges.

As central banks continue to affirm their faith in gold's stabilizing power, it’s an opportune moment for individual investors to consider increasing their precious metals investments as well. Following the lead of these nations could offer a robust shield against economic fluctuations, ensuring a more secure financial future.